Enterprise-Grade Accounting Automation: Global Compliance & Scalability for Modern Businesses

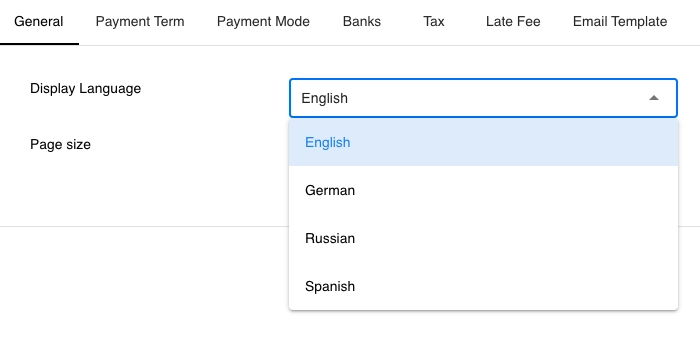

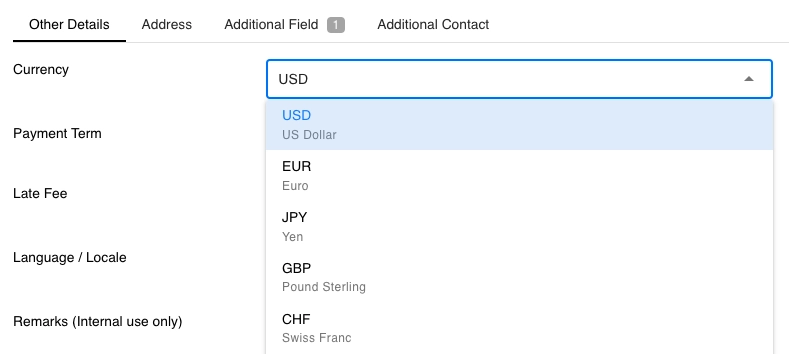

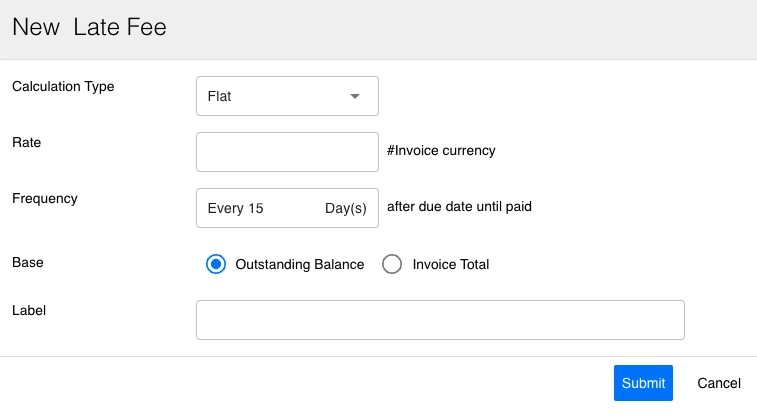

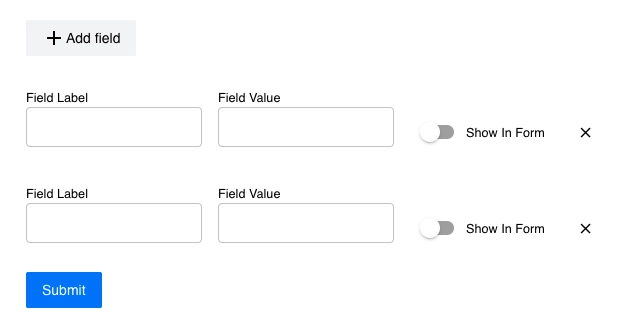

Simplify multi-entity financial management with tax automation, 140+ currency support, and seamless ERP integrations. Streamline global compliance, intercompany transactions, and real-time reporting for businesses operating across borders, ensuring unparalleled efficiency.