Financial Reporting Software for Small Businesses

- Auto-generated financial statements

- Real-time cash flow dashboards

- Smart anomaly detection alerts

- One-click accountant exports

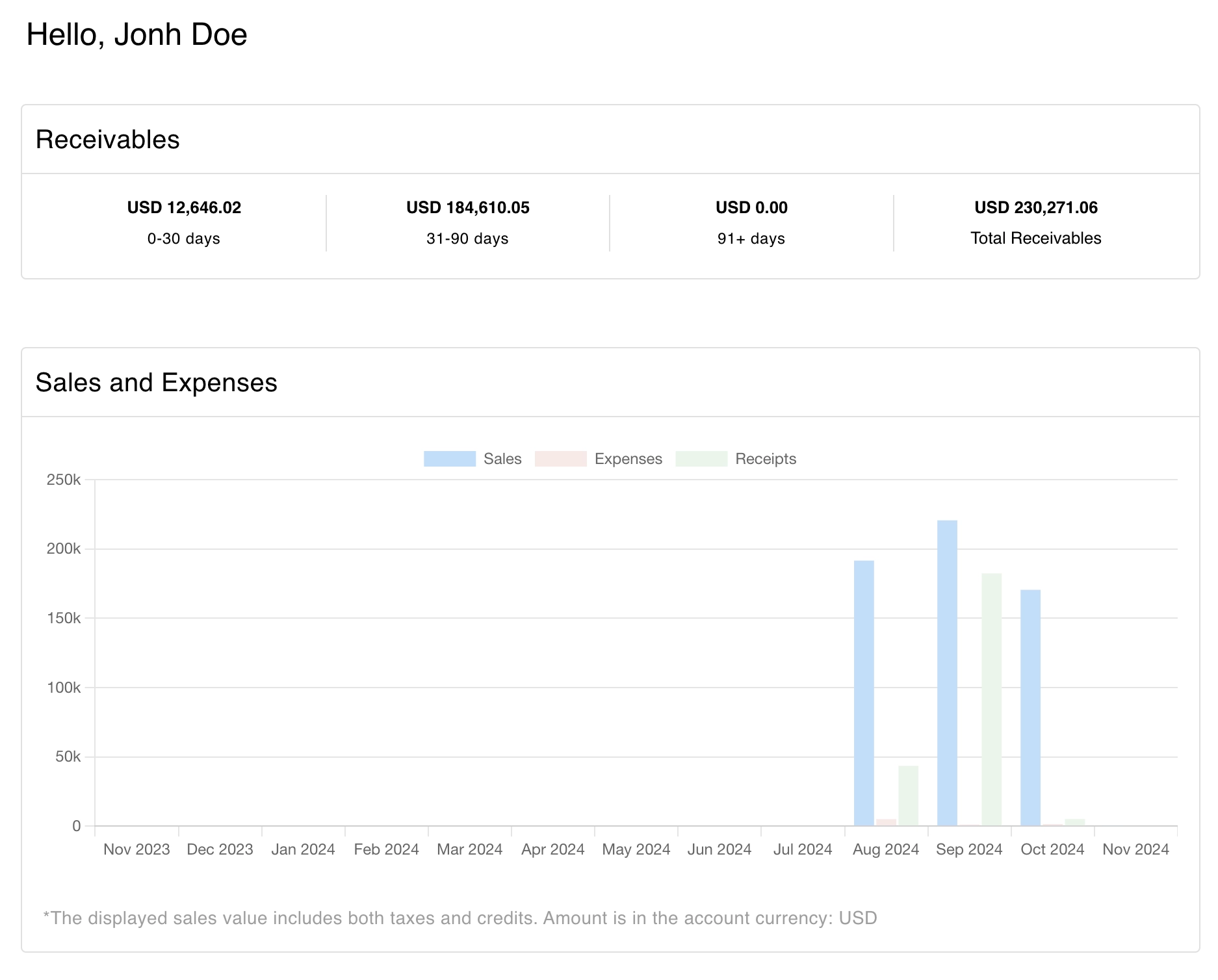

See your cash flow, unpaid invoices, expenses, and profits in one place. Customize the dashboard to show your most important numbers first for quick financial overview and immediate action.

Start Your Free Trial Today

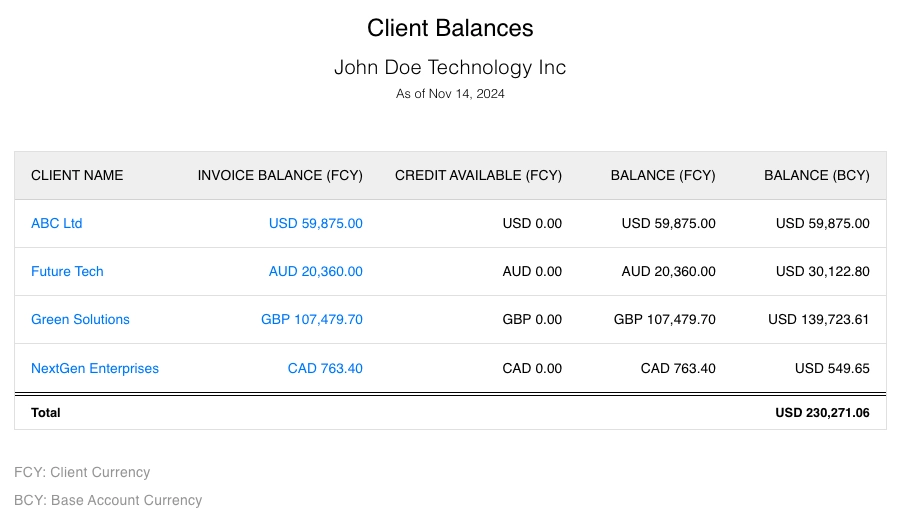

See which clients owe you money, how much is overdue, and for how long. Send payment reminders directly from the report to improve collections and boost your cash flow.

Start Your Free Trial Today

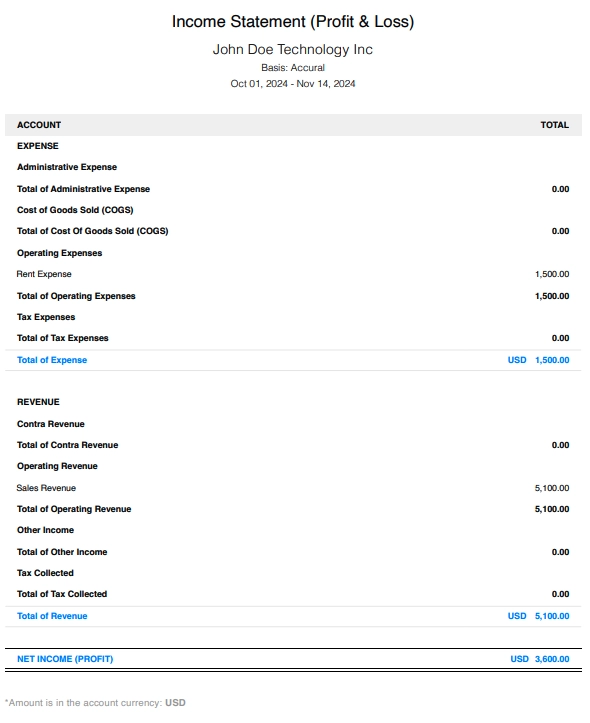

Track monthly/yearly profits, costs, and expenses. Compare periods to spot trends and identify areas for improvement in your business's financial health, maximizing profitability.

Start Your Free Trial Today

Create reports for specific dates, clients, or categories. Filter by location, project, or sales rep to find exact details and tailor reports to your needs for precise analysis.

Start Your Free Trial Today

Download reports as PDF for meetings or CSV for further analysis. Easily email reports to your accountant or share with stakeholders, fostering seamless collaboration.

Start Your Free Trial TodayAccess 15+ pre-built reports trusted by small businesses and accountants, providing comprehensive analysis for every aspect of your business:

Every transaction detail for comprehensive bookkeeping and audit trails, ensuring complete financial transparency.

Verify your books are accurate and balanced before generating final financial statements, ensuring financial integrity.

Track income, cost of goods sold (COGS), and expenses to clearly see your net profit and understand your business's financial performance.

Understand your business's financial position with a clear overview of assets, liabilities, and equity, providing a snapshot of your net worth.

Identify top-selling items or most profitable clients to optimize your sales strategies and drive revenue growth.

Track unpaid invoices by 30/60/90+ days overdue to prioritize collections and significantly improve cash flow.

Monitor deposits, refunds, and tax withholdings for complete financial oversight and accurate record-keeping.

Track spending by team, project, or client to gain granular control over your expenditures and optimize your budget.

Generate year-to-date totals for income, sales tax, and deductible expenses to simplify tax filing and ensure compliance.